Quick Links to Sections of the

Quick Links to Sections of theReport of the Citizen Advisory

Committee on Village Finances:

River Forest

Quick Links to Sections of the

Quick Links to Sections of the

Report of the Citizen Advisory

Committee on Village Finances:

River Forest

April 2010

April 2010

400 Park Avenue River Forest, Illinois 60305

708/366–8500 http://www.river–forest.us

Rex Burdett, Susan Conti, Village Trustee; Barry Fields, Rick Gillis, Stephen Hoke, Village Trustee; Thomas Lamm, Daniel Lauber, Kevin Price, Ken Slepicka, Hugh Wade, Jim Winikates, Village Trustee and Chairperson

Citizen Advisory Committee on Village Finances,

Report of the Citizen Advisory Committee on Village Finances: River Forest, Illinois (River Forest, IL: April 2010).

Chapter 1

Last summer, the village board learned that the village would not collect as much revenue for its general fund as had been expected for Fiscal Year 2010 which ends April 30, 2010. This decline in revenue would put the village’s budget into the red. Instead of a balanced budget, River Forest faced a deficit of $643,526 which will be smaller when all is accounted for at the end of the fiscal year. Planning ahead, the village projected that its expenses and revenues for the next three years will result in an expected deficit in the general fund approaching $1.5 million in each of the next three fiscal years (FY 2011, 2012, and 2013).

The village’s consultant Harry Sakai advised that:

“The present general fund expenditure and revenue structure results in structural deficits for the general fund for the foreseeable future unless new revenue sources are found and/or expenditures are controlled.”

The term “structural deficit” refers to a deficit that is not due to the cyclical nature of the economy, but a deficit that is chronic and long–term in nature. It’s a deficit that can only be cured by reducing expenditures and/or increasing revenues.

Last fall the village board established a Citizen Advisory Committee on Village Finances to “review the village’s financial condition and make recommendations with regard to cutting village expenditures and expanding revenue sources.” The committee consisted of three village trustees who are members of the Village’s Finance Committee and eight citizens chosen by the village board.

The committee first conducted an exhaustive review of the expenditures in the village’s general fund before looking at means of increasing revenues. Eighty percent of the village’s general fund pays for salaries, pensions, and other benefits of village employees.

To identify ways to reduce expenditures and the likely impacts of any reductions, the committee thoroughly reviewed the staffing levels of all village departments and the duties village employees perform. In the past two years, village staff has already been reduced 10 percent with eight full time positions eliminated to leave 74 village employees. Village department heads identified the reductions in services that the elimination of different staff positions would produce. The committee also compared the number of River Forest employees to those of comparably–sized Chicago–area suburbs and found that River Forest staffing did not exceed standards in any department. Based upon the analysis village department heads presented showing that further staff reductions would reduce essential core village services below acceptable levels, the committee concluded that it could not recommend further staff reductions. One committee member did not rule out further staff reductions, while others concluded that the village staffing was very lean and even understaffed in some departments. Finally, the committee reviewed all other budgeted expenditures over $25,000. The expenditure review covered 95 percent of general fund expenditures. The committee identified two immediate reductions in spending that would save $120,000 annually.

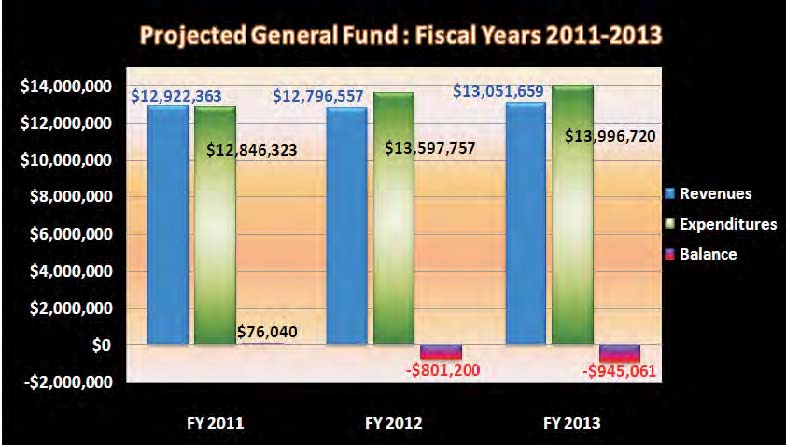

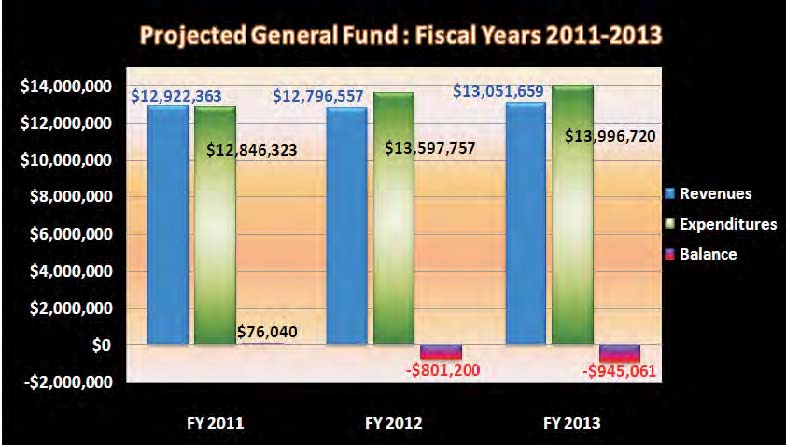

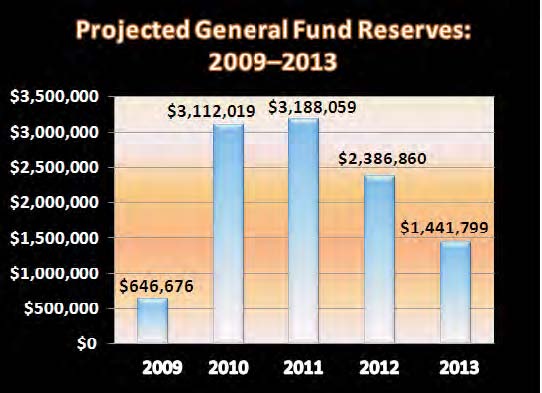

Figure 1: Projected General Fund: Fiscal Years 2011–2013

Above projections are based on estimates made in March 2010.

Next the committee examined means to increase village revenues. Illinois state law limits the revenue options available to non–home rule communities like River Forest. The most River Forest can increase property taxes revenue without conducting a referendum is the lesser of the increase in the Consumer Price Index for the previous year or five percent. A greater increase is allowed only if voters approve it by referendum.

Another source of increased revenues would be an increase in the village’s portion of the sales tax. Illinois state law requires that non–home rule communities like River Forest conduct a referendum to increase their sales tax. The catch is that state law also restricts how the revenue raised by an increase in the sales tax rate can be used. The money would not be available to the village’s general fund. It could be used to pay only for “public infrastructure” work or to reduce property taxes — neither option would help resolve the village’s structural deficit.

The committee did identify several additional long–term sources of revenue. It recognizes that economic development in the village would generate additional tax revenue, and it recommends a strong concerted effort for economic development. The committee also recommends exploring establishing a Payment in Lieu of Taxes (PILOT) program with the two tax–exempt institutions of higher learning located in River Forest.

The following are the Committee’s recommendations with the estimated annual benefit (expenditure reduction or increase in revenue). The vote of committee members present is indicated in parentheses.

Table 1: Committee Recommendations

| Action | Estimated Annual Impact on Village Budget |

| Reductions in Expenditure | |

| Schools pay cost of crossing guards currently paid by the village (9–0) | — $100,000 |

| Parochial schools pay for nurse currently paid by the village (9–0) | — $20,000 |

| Obtain competitive quotes for liability insurance (9-0) | Amount unknown |

| Increases in Revenue | |

| Increase vehicle license fees (with appropriate consideration for senior citizens) (9-0) | |

| Illustration only: Double fee | + $180,000 |

| Illustration only: Triple fee | + $360,000 |

| Increase METRA daily and monthly parking fees. Evaluate parking configuration to maximize revenue (9-0) | |

| Illustration only: Double fee | + $110,000 |

| Illustration only: Triple fee | + $220,000 |

| Negotiate a PILOT (Payment in Lieu of Taxes) program on an equitable basis with the two universities (8-0, with Winikates, who is a Trustee of Dominican University, abstaining) Note: Estimated annual cost of services to the Universities is approximately $400,000, although this amount is not considered to be a limit for such a program. | Amount unknown |

| Consider fee for fire inspections (5-2, with Winikates and Conti abstaining) | Amount unknown |

The committee has been advised that there is a gap of $801,000 and $945,000 between expenses and revenues in fiscal years 2012 and 2013 respectively. We recognize that a combination of reductions in spending and increased revenues is necessary to address this ongoing structural deficit and that these recommendations alone do not close this structural gap. Consequently, the committee also recommends:

The village board should consider increasing the village’s sales tax rate and/or property taxes. (7-2)

The committee considered and discussed many other options to reduce spending and increase revenue. None of these options received substantial support among committee members due to the infeasibility of the recommendation, insignificant or nonexistent cost savings, requirement of union approval, and/or the need for extensive further study.

![]()

Chapter 2

Facing a significant budget deficit for the upcoming Fiscal Year 2010 (May 1, 2009 through April 30, 2010), the outgoing River Forest Village Board adopted a balanced budget in April 2009 that

As is the practice when producing a new annual budget, revenue projections for the new fiscal year were based in part on the amount of revenue expected to be collected during the previous year’s fiscal year.

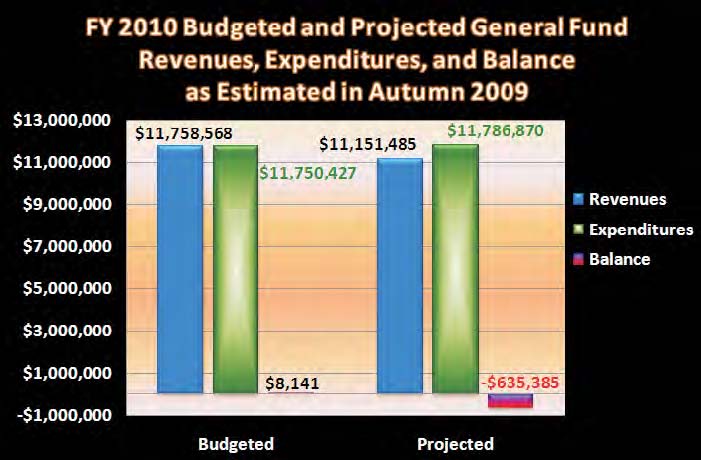

Figure 2: FY 2010 Budgeted and Projected General Fund Revenues, Expenditures, and Balance as Estimated in Autumn 2009

1. Salaries for twenty non–union employees and nine Public Works union employees were frozen May 1, 2009. Twenty firefighters and fire lieutenants agreed to take unpaid days off in Fiscal Year 2010. Salaries for 25 unionized police officers were not frozen and the police union made no other concessions.

Village staff presented the board with projections that showed deficits in each of the next three fiscal years. The Board chose not to undertake any actions to address the deficits staff forecast.

Following the April 7, 2009 Consolidated Election, a new village board took office.

Once a fiscal year ends, it takes a few weeks before all of the actual expenditures and revenues from the past 12 months can be calculated. In June 2009, staff reported to the new village board that general fund revenues for the just concluded 2009 fiscal year were less than budgeted — creating a deficit in the recently–adopted Fiscal Year 2010 budget because its revenue projections were based in part on the amount of revenue budgeted in Fiscal Year 2009.

Working with the village board’s Finance and Administration Committee, village staff revised its revenue projections to reflect the previous year’s smaller revenues and found the $8,141 anticipated surplus would become a $645,585 budget deficit if revenue trends of FY 2009 held steady throughout the new FY 2010.

Revenue sources tied to the economy account for declining village revenues, largely due to:

�Property tax collections for Fiscal Year 2009 were lower than anticipated. Collectively River Forest property owners normally pay 99 percent of the property taxes due. But last year they paid only 95 percent.

�The village’s share of state income taxes fell because incomes declined. Ten percent of income taxes that the State of Illinois collects is distributed to localities like River Forest. With incomes falling throughout the state, all localities received fewer income tax dollars than they had expected.

�Construction declined in River Forest. To increase revenues, the village board had raised building permit fees for Fiscal Year 2010. But thanks to the economy, construction here declined significantly since the previous year. The result was a reduction in building permit fee revenues below what had been expected.

A recommendation was made to the village board by the Chair of its Finance and Administration Committee to prepare revised projections for the next three fiscal years. Village staff, with the concurrence of the Village President and Chair of the Finance Administration Committee, engaged Harry Sakai, a retired finance director for Hanover Park, Glenview, Carpentersville, and South Elgin, to conduct the analysis needed to prepare those projections. Mr. Sakai’s report was presented in summary form to the village board in September 2009.

The Executive Summary states:

“The Village of River Forest general fund operations have resulted in annual deficits since Fiscal Year 2006 (2005–2006). The preliminary, unaudited result for Fiscal Year 2009 is a deficit of over $1.0 million for the village’s general fund. Finance Department staff projects a general fund deficit for this fiscal year (Fiscal Year 2010) of $635,585.”

Figure 3: General Fund Revenue, Expenditure, and Balance Trends: 2006–2010

“General fund average revenue growth has averaged 0.5 percent, while annual expenditure growth has averaged 3.7 percent from 2006 through 2010.

“The present general fund expenditure and revenue structure results in structural deficits for the general fund for the foreseeable future unless new revenue sources are found and/or expenditures are controlled.

“Projections for general fund operation for the next three fiscal years are as follows:

Table 2: General Fund Projections As Estimated in Autumn 2009

| Fiscal Year | Revenues | Expenditures | Balance |

|---|---|---|---|

| 2011 | $10,875,081 | $12,240,550 | –$1,365,469 |

| 2012 | $11,157,293 | $12,610,572 | –$1,453,279 |

| 2013 | $11,476,159 | $13,000,814 | –$1,524,655 |

“The village’s general fund unrestricted reserves (Unassigned Fund Balance) is estimated at $1.8 million on May 1, 2009. The estimated deficit for Fiscal 2010 will reduce these reserves to $1.2 million as of April 30, 2010. The projected general fund deficits are projected to deplete the remaining unrestricted reserves before the end of Fiscal Year 2011.”

Since Mr. Sakai completed his report, these projections have been refined to reflect more current data that has been assembled. The most recent projections appear in the figure below and in detail in Exhibit F.

Figure 4: Updated Projected General Fund: Fiscal Years 2011–2013

Projections based on estimates made later in March 2010.

Because the ordinance creating the committee directed it to make recommendations only on reducing village expenditures and expanding revenue sources, it did not examine the historical origins of the village’s budget gap.

The term “structural deficit” describes a chronic and long– term

deficit that can be cured only by reducing expenses and/or increasing revenues.

This structural deficit is in addition to the deficit that the current recession has caused.

![]()

Chapter 3

After reviewing Mr. Sakai’s projections, the village board unanimously created a Citizen Advisory Committee on Village Finances (hereinafter “Citizen Committee” or “the Committee”) to “review the village’s financial condition and make recommendations with regard to cutting village expenditures and expanding revenue sources.” The committee consisted of eleven members, comprised of the three members of the Finance and Administration Committee (Susan Conti, Stephen Hoke, Jim Winikates, Chairperson) along with eight River Forest residents (Rex Burdett, Barry Fields, Rick Gillis, Thomas Lamm, Daniel Lauber, Kevin Price, Ken Slepicka, Hugh Wade), . Each of the six village trustees, the Village President, and the Village Clerk nominated a resident. The ordinance establishing the committee specified that the chair of the Village’s Finance and Administration Committee would also chair the Citizen Committee.

The committee held six meetings. The committee was provided with a variety of information, including, but not limited to, an overview of the then–current general fund projections for fiscal years 2010 through 2013, a copy of the detailed “Fiscal Year 2010 General Fund Budget,” and a plethora of financial analyses and memoranda. In presentations to the Committee, the heads of the four village departments — Public Works, Police, Fire, and Administration — detailed the staffing and functions their departments perform and identified the impact on village services generated by further staff reductions.

The remainder of this report summarizes the process the committee followed and the information it reviewed before arriving at its conclusions and recommendations. To provide a context for that portion of this report, it is helpful to have a general understanding of village finances.

Local governments like the Village of River Forest use “fund accounting” in which separate “funds” are established for specific purposes. This approach is necessary largely due to restrictions on the use of monies in each fund imposed by law. All funds that are not restricted by law go into the village’s general fund. The general fund provides the money a village uses to pay for most of the services residents receive: police and fire protection, public works, and most administrative functions.

Exhibit A is the village’s “Fiscal Year 2010 General Fund Budget.” That budget will be used to briefly explain the principal sources of revenues and expenditures included in the general fund.

Collectively, the categories below constitute 80 percent of budgeted general fund revenues for Fiscal Year 2010 (83% if garbage collection fees and transfers from other funds are excluded).

Taxes. Property taxes account for 42 percent of village general fund revenues. Because River Forest is a non–home rule community, state law limits how much the village can increase property taxes in any one year. The limit – or “tax cap” — is 5 percent or the increase in the consumer price index for the previous calendar year, whichever is less. These tax caps limited the increase in the village’s 2010 tax levy (which affects property tax revenues for fiscal years 2010 and 2011) to one tenth of one percent because the Consumer Price Index had risen only 0.1 percent.

Property tax that residents pay to River Forest constitute 11 percent of their total property tax bill, down from 14 percent ten years ago.

The Communication and Utility taxes are a stipulated percentage of resident telephone and electric and gas utilities. Revenues from these sources depend on billings to residents for these services.

Intergovernmental. The sales tax charged in River Forest is 9 percent. One–ninth of this goes to the village itself. Sales tax revenue is sensitive to swings in the economy and declines when sales of taxable goods fall in River Forest.

Ten percent of Illinois income taxes collected by the State are distributed to municipalities based on their population relative to the State’s population. In Fiscal Year 2009, that came to $91.08 for each of River Forest’s 11,636 residents. Thanks to the recession, the Illinois Municipal League reports that the per capita distribution will drop to $77.00 in Fiscal Year 2010. Income tax revenue is sensitive to downturns in the economy.

Licenses and Permits. Fees for building permits account for most of this category. The village raised these fees effective May 1, 2009, but the recession has led to a decline in construction activity here and elsewhere which is why revenue from building permit fees will be less than originally projected.

Charges for Services. Garbage collection fees are the largest item in this category. Since May 1, 2009, River Forest residents have borne the full cost of garbage collection.

Exhibit B presents an analysis of the village’s budgeted general fund expenses for Fiscal Year 2010 by department and by type of expenditure (salary, benefits, pension, contractual, commodities, capital and Capital Equipment Replacement Fund [CERF]). The CERF builds up cash for major equipment purchases, such as when a fire engine needs to be replaced. The monies are transferred from the General Fund to the CERF.

As a cost–saving measure, River Forest entered into a joint venture to share Emergency 911 services (E–911) known as the West Suburban Consolidated Dispatch Center (WSCDC). Partner communities are Oak Park and Elmwood Park. The E-911 item in Exhibit B represents River Forest’s share of the costs to operate WSCDC. This figure is based on each village’s proportion of call received.

The “Sanitation” item is the cost of garbage collection services paid to Roy Strom & Company. The quarterly garbage collection fee residents pay covers all of this budget line item.

“Capital Items” cover street improvements. They are funded transferring money from other village funds to the general fund. The amount transferred each year equals the actual cost of street improvements such as repaving and other street repairs.

Since the above items are not candidates for budget cuts because they are fund transfers, pass throughs, and payments to a joint venture with other villages, the analysis in Exhibit B lists them separately near the bottom.

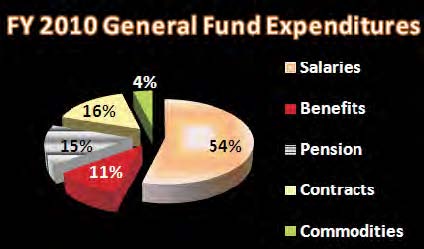

As shown in the graph below, 80 percent of discretionary village expenses are personnel–related — salaries, benefits (largely health care), and police and fire pensions. Achieving significant reductions in village expenditures would require significant reductions in village staff and the services they provide.

Figure 5: FY 2010 General Fund Expenditures

Of the village’s remaining 74 employees, 54 in the Police, Fire, and Public Works Departments are represented by unions. Their salaries and benefits are subject to collective bargaining agreements. The agreements with the unions representing police and firefighters require “interest arbitration,” which imposes binding arbitration when the Village and union cannot agree on terms. Such arbitration results in either the city’s or union’s proposal being imposed. By law, the arbitrator cannot arrive at a compromise somewhere between the two proposals. The Illinois Pension Code establishes the amount of police and fire pensions and requires the village to fund them.

The heads of each village department provided the Citizen Committee with detailed information on staffing levels and services as well as the impact of staff reductions on the delivery of village services. The following section of this report summarizes those presentations. Exhibit C shows full–time staffing levels by department for the past decade.

The River Forest Police Department has an authorized strength of 31 sworn officers and three civilian personnel. The department provides police patrols, investigations, and community services. Federal, state, and county laws as well as intergovernmental agreements with schools and others require the Police Department to provide specified services. Under the Fiscal Year 2010 budget, the department reorganized itself and eliminated one supervisory position and two patrol officers. Although the village has authorized 31 sworn positions, there are currently just 28 active sworn personnel due to officers being on leave for such reasons extended military service and duty–related medical absence.

Staffing requirements for the village are based on several factors: quality of life services, officer safety, calls for service, crime statistics, population, proximity to the City of Chicago, and foot traffic generated by the Harlem Avenue Green Line CTA station. Current Chief Frank Limon agrees with the staffing levels identified in the staffing requirements study his predecessor prepared. Chief Limon identified minimum staffing requirements for various patrol shifts to the committee and explained how the Police Department meets those requirements with current personnel.

The Police Department receives more than 10,000 calls for service annually. The Department generates revenue for the village through fines for parking violations, administrative towing, enforcement against overweight vehicles on River Forest streets, and other compliance fines.

Chief Limon identified the cost savings and impacts on the level of police protection and services that would result from eliminating sworn officer and administrative positions. Eliminating one or more sworn officer positions would lead to:

oing away with one or more of the three civilian positions would require sworn officers to perform the duties and functions of the eliminated civilian personnel — taking them away from their normal law enforcement duties. The effect would be the same as eliminating sworn officer positions.

The village’s Fire Department responded to 1,861 calls for service in 2008.

The River Forest Fire Department is an “all risk” Fire Department that provides the village with fire suppression, emergency medical services (advanced life support), rescue services, fire prevention, hazardous materials control, public education, and disaster mitigation.

The Department operates three 24–hour shifts with one lieutenant and five firefighters on each shift. At a minimum, each 24–hour shift consists of four firefighters and one lieutenant. Because firefighters work 24–hour shifts every third day, “Kelly Days” are scheduled to give time off to compensate for the fact that a 24–hour shift every third day equates to a 56 work week on an annual basis. Consequently there are four firefighters on duty at any one time.

Impact of eliminating one firefighter per shift. Occupational Safety and Health Administration (OSHA) regulations (29CFR1910.134(g)(4)) require that four firefighters be available to enter a burning structure. Initially two enter the structure and two remain outside in rescue mode. Any tasks performed by the ‘outside’ team must be work that can be abandoned without placing another firefighter at risk. The engineer/driver of the apparatus is critical to all operations and is not considered part of the ‘outside’ team.

If there are not enough firefighters on the team to meet this requirement, no firefighter could enter the burning structure until firefighters from other villages arrived under the mutual aid agreements in which River Forest participates. Reducing River Forest’s firefighting team by one firefighter per shift would prevent the Fire Department from quickly attacking a fire and would lead to an increased risk of loss of life and property.

An analysis provided to the committee showed that the village would spend more on overtime than it would save by doing away with three firefighter positions (one per shift).

In addition to the 18 firefighters and officers on shift, the department administration includes the Fire Chief, Deputy Fire Chief, Lieutenant in the Fire Prevention Bureau and Lieutenant in the Training Division.

The Deputy Fire Chief operates as the chief officer of operations and supervises all three shifts through the Fire Lieutenants. He also handles several special projects including department disciplinary matters.

The lieutenant in the Fire Prevention Bureau handles code inspections and enforcement of the 310 properties in the village that require an annual inspection as well as all code violations, plan reviews, and public education for schools, commercial businesses, and multifamily assemblies. This individual also responds to emergency calls for service. Eliminating this position will reduce capabilities to respond to secondary EMS (paramedic) responses.

The lieutenant in the Training Division is responsible for mandatory department training required by state law. He also is available to respond to emergencies, and covers scheduled overtime of shift officers which reduces overtime costs to the village.

The Public Works Department consists of 16 full-time employees. The department’s Director, Assistant Director, two Building and Zoning Inspectors, and Civil Engineering Technician perform these services:

Public Works also includes a custodian who handles janitorial duties and performs minor maintenance at village hall, the public works garage, and the West Suburban Consolidated Dispatch Center.

Public Works Operations is staffed by seven Maintenance Workers and two Water Operators supervised by a Director of Operations. Maintenance Workers are cross–trained enabling them to work in several areas of Public Works Operations.

Forestry Operations. Forestry Operations maintains approximately 9,000 trees on village right-of-ways (parkways). They prune these trees on a six-year cycle (each tree is pruned every six years). The cycle had been five years, but was increased to six when the number of maintenance workers was reduced as explained below. Public Works also consults with residents about their private property trees.

treet Operations. Public Works maintains, repairs, and improves approximately 35.5 miles of village streets, alleys, and right-of-ways. Public Works employees perform the following services:

Water Operations. The village’s two water operators assure an adequate and continuous uninterrupted flow of high quality water purchased from the City of Chicago for domestic and fire–fighting purposes. These two employees

The committee examined how further staff reductions in Public Works would affect village services. During the past three years, the number of maintenance workers was reduced from nine to seven. Currently the Department is struggling to keep up with the work load. Any additional reduction in the number of maintenance workers would slow down snow and ice removal which can affect public safety. Any additional reduction in the number of maintenance workers could lead to extending the tree trimming cycle to seven years and possibly contracting out some services. Replacing Maintenance Workers with contracted services is unlikely to result in significant savings to the Village.

The Administration Department consists of six individuals: the Village Administrator, an Administrative Assistant, the Village Treasurer, an Accounting Supervisor, a Utility Billing Clerk, and a Cashier/Front Desk Receptionist. The Assistant Village Administrator position has been vacant since 2007. A substantial portion of the Utility Clerk’s salary is charged to the Village’s Water and Sewer Fund.

Eliminating any of these positions would lead to work not being performed or having to be outsourced which would result in no financial savings to the village. For example, without a Front Desk Receptionist, the village front desk could not serve residents who come to village hall. Doing away with the Utility Billing Clerk position would result in water bills not being prepared. Eliminating either the Accounting Supervisor or the Village Treasurer result in none of the required accounting, cash management, financial reporting, budgeting, accounts payable and payroll tasks being done and would require that these tasks be outsourced. These are essential tasks that cannot be abolished.

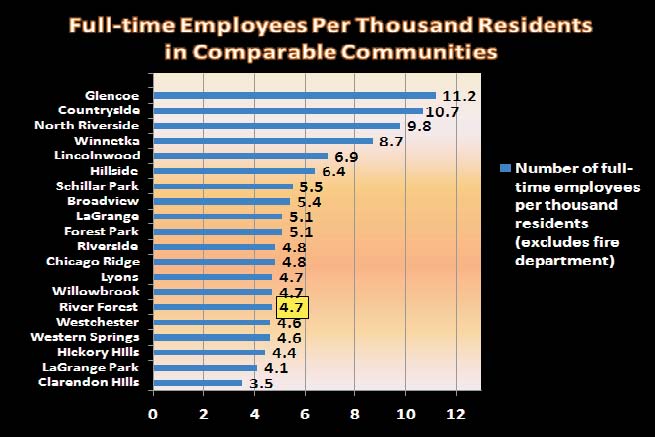

To help determine whether the amount of staff River Forest employs is out of line with the size of the village, staff complied the information shown in the graph below for comparably–sized communities in the Chicago area. These are communities with a population and land area within 50 percent of River Forest’s. This research included staff levels (number of employees) in each respective department of the selected towns. The data was distilled down to a ratio of employees of each town per thousand residents. Because several of the towns do not have their own full-time fire department, fire department numbers were excluded. As illustrated in the graph above, the number of village employees per thousand residents is lower than in 72 percent of the comparable municipalities.

Figure 6: Full–time Employees Per Thousand Residents in Comparable Communities

Precise comparisons are difficult due to the wide variation in the services provided by different public works departments. For example, it is rare for a public works department to perform building inspections, engineering, right of way maintenance operations, water operations, and zoning support like River Forest’s Public Works Department does. The other factor that makes precise comparisons difficult is the variation from town to town as to which functions they outsource. Despite these caveats, these comparisons illustrate that River Forest staffing tends toward the lean side.

The complete staffing survey is published in Exhibit C.

One committee member sought to learn why the cost of River Forest Police and Fire Department services was significantly greater than Western Springs, a comparably–sized community. A comparison of the two villages’ most recent annual budgets for these departments shows higher costs in River Forest.

Table 3: Comparison of River Forest and Western Springs Public Safety Expenses

| Department | River Forest | Western Springs |

|---|---|---|

| Police | $4,210,631 | $3,504,000 |

| Fire | $2,942,372 | $1,464,268 |

The village’s police and fire chiefs provided the committee with written responses to this request, which are presented in Exhibit D. River Forest has a larger Police Department (28 sworn officers compared to 21 in Western Springs) in part due to fewer crimes being reported in Western Springs (137) than in River Forest (497). The difference in the police budgets is due to contributions to the police pensions being about $395,180 less for Western Springs and salaries and benefits totaling $520,676 less than in River Forest which has seven more sworn officers that Western Springs. With smaller amounts spent on contracts, commodities, and capital expenses, the annual cost per sworn police officer is nearly $10,000 less in River Forest.

The difference in cost for fire protection is attributable to Western Springs using a volunteer fire department rather than fire–fighting professionals. The committee does not recommend switching to a volunteer fire department in River Forest. The committee does recommend that the village board consider alternative fire protection models to reduce costs such as establishing a multi– village fire protection district with nearby villages.

After considering the staffing survey, current village staffing levels, previous staff reductions, and the impact on village services from any further staff reductions, the committee declined to recommend further staff reductions. One committee member did rule out further staff reductions, while others concluded that the village has a very lean staff or is understaffed in some departments.

The committee next analyzed other general fund expenditures consisting of contractual services and commodities. The committee reviewed budgeted expenditures of $25,000 or more — which amount to 71 percent of General Fund of these costs. Exhibit E lists all of these expenditures There was extensive discussion about the nature of these items and why they were necessary village expenditures. The committee identified several expenditures that could be eliminated and made other recommendations, one of which has already been implemented.

The village currently pays the salaries of school crossing guards in the village. The committee recommended discontinuing this practice and that the schools should pay the costs of their school crossing guards. The estimated annual savings to the village is approximately $100,000.

The village also pays the cost of a nurse who serves the parochial schools in the Village. The committee recommended discontinuing this practice and that parochial schools pay for their nurse. The estimated annual savings to the village is approximately $20,000.

The village is a member of the Intergovernmental Risk Management Agency (IRMA). IRMA is a risk sharing pool of 74 local municipalities and special service districts in northeastern Illinois that have joined together to manage and fund their property, casualty, and worker’s compensation claims. All members also participate in a comprehensive risk management program. The committee recommended that the village obtain competitive quotes for the coverages provided by IRMA.

As previously noted, River Forest shares the cost of the West Suburban Consolidated Dispatch Center (WSCDC) with two other villages. Our share of the costs of the WSCDC’s E–911 services are based on relative call volumes. The committee observed that the village’s share of costs of WSCDC seemed high given the relative size of River Forest compared to Oak Park and particularly Elmwood Park. Prompted by the Committee’s discussion, River Forest village staff initiated procedural changes in the Police Department that are expected to reduce call volume and, consequently, the village’s share of WSCDC costs.

![]()

Chapter 4

The table below summarizes the recommendations of the Citizen Advisory Committee on Village Finances.

Table 4: Committee Recommendations

| Action | Estimated Annual Impact on Village Budget |

| Reductions in Expenditure | |

| Schools pay cost of crossing guards currently paid by the village (9–0) | — $100,000 |

| Parochial schools pay for nurse currently paid by the village (9–0) | — $20,000 |

| Obtain competitive quotes for liability insurance (9-0) | Amount unknown |

| Increases in Revenue | |

| Increase vehicle license fees (with appropriate consideration for senior citizens) (9-0) | |

| Illustration only: Double fee | + $180,000 |

| Illustration only: Triple fee | + $360,000 |

| Increase METRA daily and monthly parking fees. Evaluate parking configuration to maximize revenue (9-0) | |

| Illustration only: Double fee | + $110,000 |

| Illustration only: Triple fee | + $220,000 |

| Negotiate a PILOT (Payment in Lieu of Taxes) program on an equitable basis with the two universities (8-0, with Winikates, who is a Trustee of Dominican University, abstaining) Note: Estimated annual cost of services to the Universities is approximately $400,000, although this amount is not considered to be a limit for such a program. | Amount unknown |

| Consider fee for fire inspections (5-2, with Winikates and Conti abstaining) | Unknown |

Committee votes are in parentheses.

To address the village’s structural deficit, the committee identified several means of increasing village revenues both immediately and in the long term.

River Forest receives fees for vehicle and business licenses and building permits. It also charges for some services like parking for METRA commuters. The committee reviewed and discussed several of these revenue items.

Fees for garbage collection, building permits, and business licenses were increased May 1, 2009. The committee concluded that additional increases in these fees was not appropriate. The committee discussed imposing an administrative surcharge on the garbage collection service fee, and a separate fee for leaf collection. Neither suggestion garnered broad committee support.

The committee recommended that the village increase vehicle license fees (with an appropriate discount for senior citizens) and increase daily and monthly fees for METRA parking. It suggested conducting an evaluation of the parking configuration to maximize revenue. The committee does not make any specific recommendation as to the exact amount these fees should be increased.

The committee also recommended that the village consider a fee for fire inspections.

Committee members discussed the possibility of creating a fire protection district with nearby villages to reduce the cost of fire protection services. Staff will look into this possibility, recognizing that it would take years to create one and therefore will not generate immediate cost savings.

Municipalities around the nation have established “Payment in Lieu of Taxes” (PILOT) programs with nonprofit institutions within their borders. The real estate these nonprofit entities owned is generally exempt from property taxes. PILOT payments seek to cover at least part of the cost of municipal services delivered to these nonprofit institutions. River Forest has two tax–exempts schools of higher learning: Dominican University and Concordia University.

Illinois law (35 ILCS 200/15-30) specifically authorizes taxing bodies to enter into a “mutually acceptable agreement with the owner of any exempt property whereby the owner agrees to make payments to the taxing district for the direct and indirect cost of services provided by the district.” The statute expressly prohibits a municipality from using administrative approvals such as zoning to coerce an owner into entering into a PILOT agreement. The statute also limits the duration of a PILOT agreement to five years with a single five– year renewal.

The committee requested and received an analysis, Exhibit G, from village staff that estimated the village’s cost of providing services to the two universities.

The committee recommended that the village negotiate a PILOT program on an equitable basis with the two universities. The committee realizes that these negotiations may take time and recommends that the village immediately begin negotiations with the two univeristies.

The committee recognizes that economic development can increase village tax revenues. It was also noted that unlike River Forest, many municipalities employ a full time director of economic development. The committee recommends that the village make a strong concerted effort to nurture and further economic development. The committee recognizes that this is a long–term strategy that will not immediately reduce the structural gap between revenues and expenditures.

The Committee’s recommendations for reductions in spending and increases in revenue appear at the beginning of this chapter.

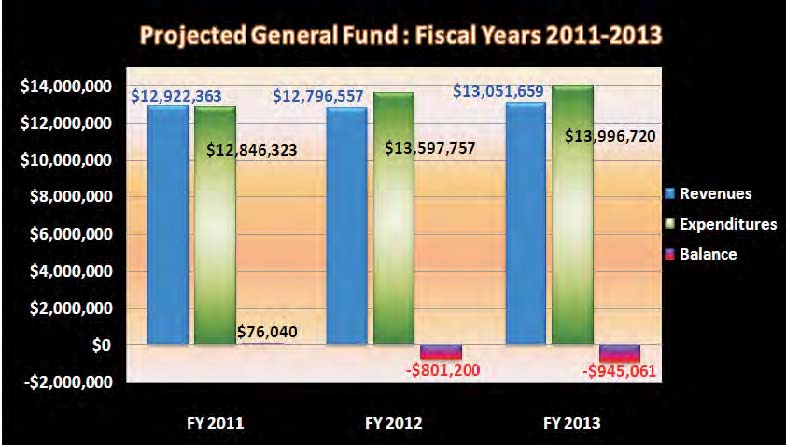

Absent further action to increase revenues, River Forest’s reserves will run out in Fiscal Year 2014 based on the 2009–2013 trends. The graph below shows the effect on the village’s reserves if the Committee’s recommendations are not enacted and other actions are not taken to increase revenues.[The village board intends to use a one–time contribution to the general fund available due to termination of the sales tax portion of the village’s Tax Increment Tax District to balance its budgets for fiscal years 2010 and 2011, which will exhaust these funds. Without those funds, the village’s reserves would run out in 2013 rather than 2014. erty and sales tax revenues from the TIF district are incorporated into the projections for fiscal years 2011–2013. The challenge of the structural deficit will not disappear.]

The committee has been advised that approximately $800,000 to $950,000 in annual sustainable expenditure reductions and/or increased revenue is necessary to address the structural deficit River Forest faces in fiscal years 2012 and 2013.

Termination of Sales Tax Allocation Fund of the village’s Tax Increment Finance District in late 2009 and termination of the TIF District itself in December 2010 will generate short–term revenue for the village that enables River Forest to buy some time to resolve its structural deficit.

River Forest will use revenue from the Sales Tax Allocation Fund to help balance its current Fiscal Year 2010 budget and the upcoming Fiscal Year 2011 budget. But this will completely exhaust funds from the Sales Tax Allocation Fund and have no effect on the village’s structural deficit in fiscal years 2012, 2013, and beyond.

Distribution of surplus funds from the TIF District itself contribute $1,168,470 to the current Fiscal Year 2010 budget and $329,382 to Fiscal Year 2011. No additional surplus funds will exist for future years. Additional property and sales tax revenues from the TIF district are incorporated into the projections for fiscal years 2011-2013. The challenge of the structual deficit will not disappear.

Figure 7: Projected General Fund Reserves: 2009–2013

Unable to identify further responsible reductions in spending and increases in non–tax revenue, and recognizing that the village needs to achieve additional revenue before Fiscal Year 2012, the committee concluded:

The village board should consider increasing the village’s sales tax and/or property tax.

Property tax that residents pay to River Forest constitute 11 percent of their total property tax bill, down from 14 percent ten years ago.

Being a non–home rule village, River Forest is subject to the ” tax cap” limitations discussed earlier. The village can increase property taxes without a referendum by no more than 5 percent or the previous calendar year’s increase in the Consumer Price Index (CPI), whichever is less — limits that preclude closing the budget gap by action of the village board. Any greater increase in property tax requires approval by voter referendum.

The other tax that can help close the gap is the sales tax. As a non–home rule community, River Forest can increase the sales tax only by voter referendum, and even then, state law drastically limits how the increased sales tax revenue an be spent. Non–home rule communities can use these increased sales tax revenues only for “public infrastructure” or “property tax relief” (65 ILCS 5/8-11-1.2). An increase in the sales tax would not provide new revenues that could be used for general operating purposes — which is what the village needs to close its structural budget gap. A sales tax increase would help the village only if the General Assembly lifted this restriction by amending the state statutes. A bill has been introduced to do just this, but there is no guarantee it will be adopted. If adopted, the village could raise the sales tax if the voters approve by referendum.

Figure 8: Projected General Fund: Fiscal Years 2011–2013

Projections are based on estimates made in Feburary 2010.

The committee takes no position on whether the Village of River Forest should seek to become a home rule community which would have to be approved by voter referendum.

The committee considered and discussed many other matters for reducing expenditures and increasing revenues, a few of which are mentioned earlier in this report. Among the other possibilities the committee discussed that are not included as committee recommendations were:

Many of these were suggestions of individual committee members and did not receive widespread committee support. They were not included as final committee recommendations due to infeasibility of the recommendation, perceived insignificant or nonexistent cost savings, requirement of union approval, and a need for extensive further study. Nevertheless, the committee believes there is benefit in communicating these matters to the village board.

![]()

Exhibits: The exhibits are too complex to convert to html. Download a PDF file of all exhibits by clicking here