| Precinct | Yes | No |

| 1 | 149 | 151 |

| 2 | 245 | 254 |

| 3 | 271 | 214 |

| 4 | 296 | 295 |

| 5 | 194 | 177 |

| 6 | 198 | 201 |

| 7 | 295 | 253 |

| 8 | 196 | 165 |

| 9 | 167 | 147 |

| 10 | 285 | 232 |

| Total | 2,296 | 2,089 |

The nearly five point margin allows the River Forest Village Board to increase the sales tax by 1 percent, to 9.5 percent, the same as neighboring communities Oak Park, Melrose Park, and Elmwood Park.

A big “Thank you” to all who voted “Yes.” The Village Board must notify the State of Illinois of the 1 percent increase by January 1 for the increase to go into effect next July (which under state law is the soonest it can go into effect).

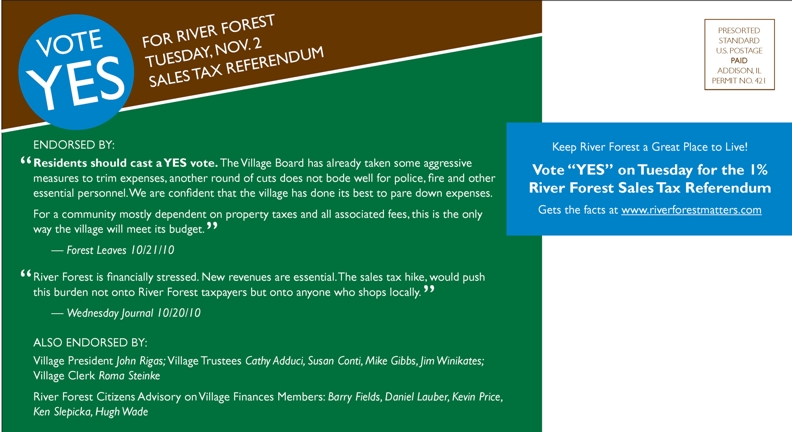

| Forest Leaves and Wednesday Journal both say vote “Yes” on Tuesday |

Improve police protection

Maintain fire protection

Plow our streets in winter

Get the leaves cleared from the streets

Prevent further severe flooding

Fix streets and our aging sewer system

Generate economic development

Prevent further cutbacks that would reduce our property values

Keep River Forest a desirable place to live and raise a family

Despite cutting expenses to the bone, River Forest needs us voters to approve a 1 percent increase in our sales tax next Tuesday, November 2 in order to keep River Forest the first–class community we moved to.

The village isn’t crying “wolf.” River Forest's financial crisis is very real — as thoroughly documented in the report of the Citizens Advisory Committee on Village Finances. Our fire department has been cut back so much that if the village had to eliminate one more firefighter position, it couldn't legally respond to fires. Streets aren't being repaired as quickly as before. Preventative maintenance has fallen by the wayside. Tree trimming has been cut back. Important village staff positions remain vacant and our short handed staff is overloaded and cannot perform at peak efficiency.

Wonder why you haven’t received a village newsletter in the mail for a year? To cut expenses, River Forest switched to an online newsletter a year ago with notifications emailed to those who sign up for them. But due to budget constraints, staff never sent a mailing to residents telling them how to sign up online or request a printed copy sent via the Postal Service. Fewer than 200 of the village's nearly 12,000 residents have signed up for the online newsletter. With all the staff layoffs, the village does not have the staff available to communicate adquately with residents.

Wonder why the village no longer pays for school crossing guards? It doesn’t have the funds to afford $100,000 a year. The village had spent over $1 million subsidizing the schools during the past ten years. Click here for other spending cuts already implemented.

On August 9, the River Forest Village Board voted to place on the November 2 ballot a referendum to increase the sales tax by one percentage point. State law requires that a referendum be conducted because River Forest does not have home rule.

If approved, the sales tax will enable the village to close most of the gaping budget deficit for the next few years as explained in the report of the Citizens Advisory Committee on Village Finances. Click here to download a PDF file of the report.

While the village board could have sought an increase in property taxes (just 11% of the property taxes we pay go to the village; our superb public school districts get 70%), most village trustees concluded that an increase in sales tax would be less burdensome for residents and much of it would be paid by nonresidents shopping in River Forest. Our sales tax is lower than that in many neighboring communities. The requested one percent increase will make our sales tax the same as Oak Park, Melrose Park, Elmwood Park, and scores of other suburbs.

| Referendum on the November 2 Ballot: “Shall the Board of Trustees and the President of the Village of River Forest be authorized to levy a 1% sales tax to be used for municipal operations, public infrastructure, or property tax relief?” |

You Get What You Pay For:

The Lesson of School Districts 90 and 200

Great schools like those in districts 90 and 200 don’t come free. We’re willing to pay substantial taxes for all the superb services our public schools provide our children — and we get what we pay for. The same holds true for village government. We won’t get a great village government that provides the superb services we want unless we’re willing to pay for them. This 1% addition to the sales tax is a small price to pay for better services from our village government.

Having cut spending to the bone as documented in the report of the Citizens Advisory Committee on Village Finances, River Forest’s only remaining way to maintain the current level of village services is to generate new revenues. Read it online here. The least regressive and least painful means is through a small increase in the sales tax. If this one percent increase is not approved, there is little doubt that further cuts will have to be made to village services. As the report makes clear, “structural deficits” assure that River Forest will exhaust its reserve funds and lack adequate funding to operate the village in just a few years.

For example, the Fire Department is already at minimum staffing levels and could not, under law, even respond to a fire if the number of firefighters were further reduced. If the sales tax is not increased, it’s likely that the village will have to cut back on street repairs, tree trimming (already reduced 20 percent), sewer repairs, and other village services. Flooding will get worse. Further staff reductions to an already understaffed village will lead to unrepaired deteriorated streets, sewers, and other features of River Forest under the responsibility of the village.

River Forest used to be proactive and able to prevent problems. But with this ongoing budget crisis and cutbacks already made, the village has had to become reactive and follow the more costly approach of responding to problems instead of preventing them. When it comes to running a village, Ben Franklin was right: A stitch in time does save nine. But you can’t apply the stitches when you can’t even afford the needle and thread.

What opponents say. Some folk argue against this modest hike in the sales tax. They voice the mantra of the need to cut waste and mismanagement out of the village budget. Dare them to name examples of actual waste or mismanagement — they can’t because any waste or mismanagement has been eliminated. Dare them to identify any more expenses that can realistically be cut without reducing essential village services. They’ll rant about pension costs which I readily agree are out of control. But pensions are determined by the state legislature, not individual cities. Pensions are literally are out of our hands. The sales tax referendum is needed to maintain village services, not to fund the pensions imposed by the General Assembly in Springfield. They’ll argue that making our sales tax the same rate as scores of other suburbs like Oak Park, Melrose Park, and Elmwood Park will discourage people from shopping or dining in River Forest — a contention for which they have no factual basis. Do you really think somebody will not shop or dine in River Forest because our sales tax is the same as our neighboring communities? With all due respect, their arguments hold no water.